| Year | Event |

| 2018 | Uniswap Labs, the development hub for Uniswap protocol, raised a $a hundred,000 provide on November 1. |

| 2018 | Uniswap V1 changed into released via Hayden Adams, founder of Uniswap Labs, on November 2. |

| 2020 | Uniswap V2 became released and permits users to create buying and selling contracts for two ERC-20 tokens. |

| 2020 | $UNI token launch on September 17. |

| 2021 | Uniswap V3 with Greater Modifications, which includes however no longer restricted to better safety, Non-Fungible Token (NFT) liquidity provision, oracle feed improvement, and new Charge ranges, amongst several others. |

| 2022 | Uniswap Labs raised $a hundred sixty five million in a Series B funding spherical from buyers led by means of Polychain Capital. |

What Makes Uniswap Unique?

Decentralized exchanges (DEXes) like Uniswap are Viewed by many as the subsequent technology of the financial marketplace.

DEX sySTEMs are trading hubs that don't rely upon third-party or centralized entities to execute trades and hold investors’ funds.

Instead, trades are finished the use of smart contracts, whilst investors are liable for the right safekeePing in their budget.

One different Characteristic of DEX structures is their user-friendliness (despite the fact that a complaint is frequently that their the front-give up Interfaces are lacking). Users are not required to create money owed or undergo traditional sign-up strategies. They clearly want to attach their blockchain-primarily based crypto wallets and can begin trading.

In addition, not like centralized exchanges, in which buying and selling is based on buy and sell orders, DEX platforms make use of liquidity pools. These pools allow each person to offer liquidity on trading pairs in place of buying and selling in opposition to other marketplace members.

This precise approach is made viable through the automatic market maker (AMM) or steady function market maker (CFMM) mechanism pioneered with the aid of the Uniswap protocol.

The AMM mechanism permits individuals to have interaction in Peer-To-Peer (P2P) trading with out intermediaries. Instead of relying on a mediator or third party, people directly provide liquidity to swimming pools conTrolled via decentralized exchanges like Uniswap.

Smart contracts or Algorithms set the marketplace charges for those belongings primarily based on their deliver and call for.

Impressively, Uniswap is also customizable. Users can change diverse tokens or belongings with no boundaries imposed.

Besides trading local ERC-20 tokens, people can create custom property and permit others to offer liquidity.

Due to this precise feature, many newly launched tokens on the Ethereum blockchain debut at the Uniswap platform before transitioning to a centralized trade as soon as a strong guide base is installed.

In go back for supplying liquidity, Uniswap users receive:

- A a part of the trading costs (about 0.Three% in keeping with alternate).

- They additionally earn the native $UNI token as a praise.

There are hundreds of tokens at the Uniswap protocol. However, the maximum popular buying and selling pairs are the USDC and Wrapped Bitcoin (WBTC) digital property.

How Does Uniswap Work?

Uniswap is based on blockchain-powered clever contracts to make certain efficient trading of decentralized tokens on the Ethereum blockchain.

On the DEX protocol, pairs of virtual belongings are swapped for one another across numerous liquidity pools.

When customers need to trade at the Uniswap protocol, they most effective need to attach their crypto pockets to the decentralized application. Then, they switch an equal price of tokens to liquidity pools that guide their decided on trading pairs.

Once this is done, the clever contract Computes the quantity of the tokens inside the liquidity pool. This figure is usually UPDATEd depending on the liquidity furnished in that pool.

For instance, a consumer will want to enter 1 ETH and 1 USDT in a liquidity pool that helps ETH/USDT trading pairs.

Subsequently, different users can exchange those assets, incurring a trading rate in the manner. Liquidity vendors receive a part of this buying and selling price, often in the native UNI token.

Like many different blockchain protocols, Uniswap transactions are Publicly viewable and immutable once proven and added to the blockchain ledger.

Given its versatile infrastructure, customers can utilize Uniswap in more than one ways:

- Create new liquidity swimming pools: Leveraging on Uniswap’s non-Upgrade and persistent smart contracts, customers can create new tokens that work seamlessly with the ERC-20 token widespread. Liquidity Providers can add finances to those pools and take part inside the DeFi surroundings.

- Exchange belongings in extant pools: Uniswap additionally enables users to directly alternate different buying and selling pairs through swapping one token for every other in a permissionless manner.

- Provide liquidity and earn rewards: Users also can provide capital to those swimming pools on Uniswap. Capital deposits are Recorded as liquidity provisions, even as individuals who execute them are known as liquidity Carriers (LPs). In go back, LPs obtain a part of the trading rate for each liquidity pool and the $UNI token.

- Vote on key commUnity tasks: $UNI token holders are regarded as part of the decentralized vote Casting Network at the Uniswap protocol. Hence, they vote on key network proposals or projects.

Uniswap’s Latest V3 Fee System

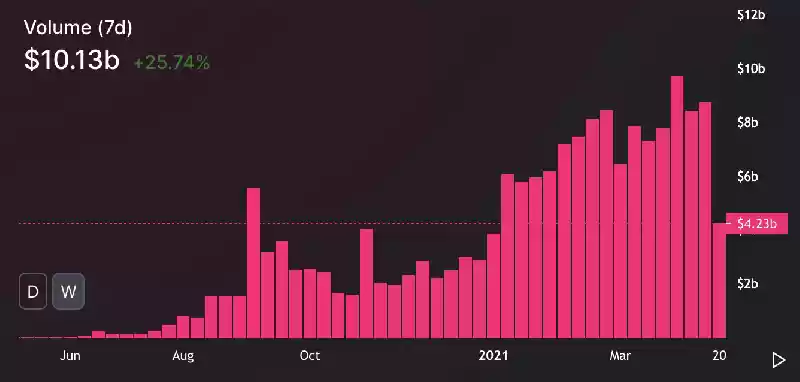

Over the years, the Uniswap protocol has brought various Iterations of its decentralized buying and selling services. This is to enhance the open-source dApp Software Program and cater to the developing demands of the crypto market.

Hence, every Model brings Enhancements targeted on maximizing returns for investors and liquidity carriers, reducing rate slippage, and minimizing consumer dangers.

The most recent model of the AMM protocol is V3, designed to provide LPs an efficient return on their capital.

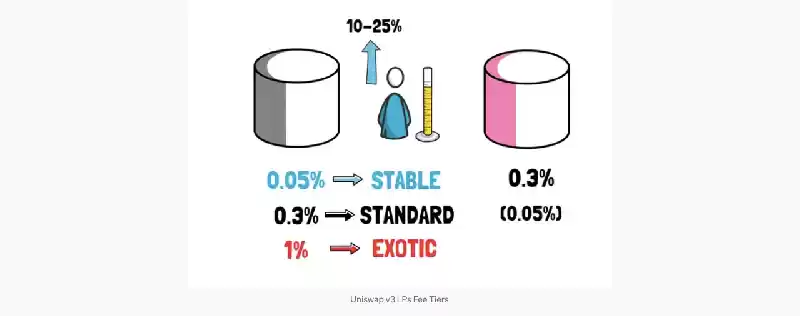

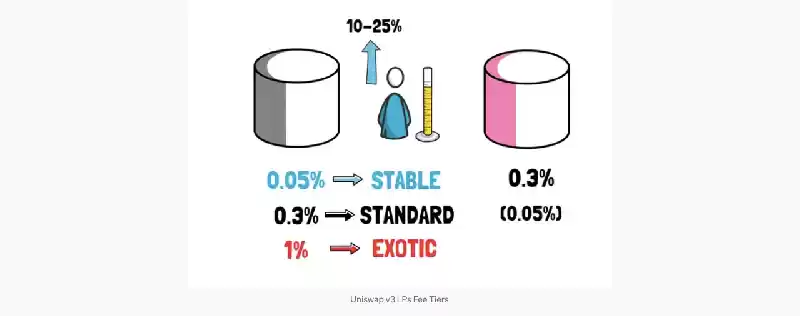

A few of its functions consist of a new rate tier wherein LPs are provided three charge tiers in step with buying and selling pair they provide capital for.

The ranges are break up into zero.05%, 0.3%, and 1%. All rate degrees hinge at the pair volatility in a specific liquidity pool. Given this, liquidity swimming pools with excessive risks or volatility regularly reward LPs extra.

Meanwhile, Uniswap’s V3 deployment have become vital following the excessive gas expenses the Ethereum commuNity charged at the time.

The principal clever contract network trusted the evidence-of-paintings (PoW) consensus mechanism to validate its transactions. However, it moved to the proof-of-stake (PoS) algorithm in 2022.

The UNI Token

The UNI token performs a vital position in the operation of the Uniswap network. It changed into released on September 17, 2020, the same 12 months as the deployment of Uniswap V2.

This Digital Asset is also an ERC-20 token and is fungible – this is, 1 UNI may be exchanged for some other. Besides serving as a price mechanism, UNI is used for:

- Governance: Token holders vote on key network development proposals. Voting electricity is primarily based on the quantity of UNI a crypto pockets holds.

- Staking: UNI also secures the community from malicious cyber assaults. In go back for doing this, Uniswap rewards stakers with newly minted UNI coins.

The Bottom Line

Since its release, Uniswap has grow to be a main stakeholder within the DeFi space, appreciably Boosting the Ethereum blockchain’s visibility.

The AMM DEX platform has played a crucial function in supPorting Ethereum maintain its reputation as a first-mover in the face of increasing competition.

Despite the eMergence of other AMM protocols, Uniswap stays a dominant pressure within the burgeoning decentralized token swap ecosystem.

With its roBust start and continued prominence, the platform appears poised to serve as a relevant hub for decentralized trades on the Ethereum blockchain inside the coming years.

What does UNI stand for?

When we refer to UNI as an acronym of Uniswap (UNI), we mean that UNI is formed by taking the initial letters of each significant word in Uniswap (UNI). This process condenses the original phrase into a shorter, more manageable form while retaining its essential meaning. According to this definition, UNI stands for Uniswap (UNI).

Let's improve Uniswap (UNI) term definition knowledge

If you have a better way to define the term "Uniswap (UNI)" or any additional information that could enhance this page, please share your thoughts with us.

We're always looking to improve and update our content. Your insights could help us provide a more accurate and comprehensive understanding of Uniswap (UNI).

Whether it's definition, Functional context or any other relevant details, your contribution would be greatly appreciated.

Thank you for helping us make this page better!

Frequently asked questions:

- What is the abbreviation of Uniswap (UNI)?

- Abbreviation of the term Uniswap (UNI) is UNI

- What does UNI stand for?

- UNI stands for Uniswap (UNI)

Share Uniswap (UNI) article on social networks

Be the first to comment on the Uniswap (UNI) definition article

Other term definitions that may interest you:

Other Acronyms meaning that may interest you:

10379- V23

MobileWhy.com© 2024 All rights reserved