Ripple (XRP)

What is Ripple (XRP) in Crypto? How to Buy, Use Cases and SEC

Definition and meaning of Ripple (XRP)

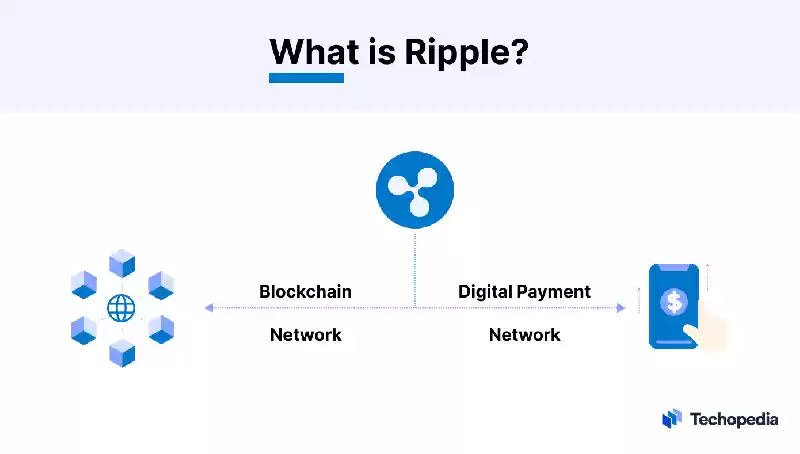

Ripple is a decentralized Platform that lets in Digital and fiat currencies to be transferred across worldwide borders at the same Network without an middleman, in actual-time. Ripple is thought for its virtual fee Protocol and XRP, its local Cryptocurrency.

The platForm, which became advanced and promoted by Ripple Labs, has important Components: RippleNet and XRP Ledger (XRPL).

RippleNet is a network of economic institutions that use Ripple’s technology to permit pass-border Transactions. XRP Ledger is a decentralized, open-supply Blockchain that tactics and verifies transactions at the commUnity.

XRP, the ledger’s native foreign money, acts as a Bridge forex to growth the Velocity and decrease the price of cross-border transactions. Using XRP as a Mediator foreign money reduces the need for pre-funded accounts and enables more green transactions than cHanged into previously viable thru conventional monetary establishments.

XRP, the ledger’s native foreign money, acts as a Bridge forex to growth the Velocity and decrease the price of cross-border transactions. Using XRP as a Mediator foreign money reduces the need for pre-funded accounts and enables more green transactions than cHanged into previously viable thru conventional monetary establishments.

Ripple’s Role in DeFi

While Ripple itself isn't a Decentralized Finance (DeFi) platform, it has performed an vital Function in promoting DeFi through providing the vital gear and infrastructure for the development of recent DeFi tasks. The Ripple Transaction Protocol (RTXP) and XRP, as an Instance, were used as Constructing bLocks for DeFi applications that bridge the gap between traditional monetary establishments and decentralized economic offerings.

Ripple’s supporters hold the platform has contributed to the growth of the DeFi environment and helped Make monetary services extra available and inclusive for people in unserved and underserved elements of the sector.

It’s vital to note, however, that Ripple additionally has critics, a lot of whom question whether the platform is really decentralized.

XRP Ledger and Consensus

One critical question has to do with the manner the platform’s consensus mechanism works. Unlike cryptocurrencies that employ decentralized consensus mechanisms, such as proof-of-work (PoW) or evidence-of-stake (PoS), Ripple employs a completely unique protocol that requires a restrained Variety of Nodes known as validators to reach at a consensus.

The Decentralization of a cryptocurrency is an crucial issue of its security as it prEvents any unmarried Entity from having an excessive aMount of manipulate over the commuNity. With Ripple’s consensus protocol, but, a small organization of validators has the strength to approve transactions. Critics factor out this additionally gives them the electricity to collude and manipulate the community.

Critics have also questioned XRP’s usefulness as a bridge currency while different cryptocurrencies and fiat currencies might be used for the equal reason. There has additionally been quite a piece of discussion over whether or not it’s genuinely necessary for a majority of the overall supply of XRP to be held in escrow with the aid of Ripple Labs and its founders.

History

Ripple become created in 2012 via Chris Larsen and Jed McCaleb, two famous marketers and pioneers in the cryptocurrency and blockchain enterprise. In 2013, OpenCoin rebranded Ripple Labs. Since that point, Ripple Labs has worked to improve the XRP Ledger, promote using XRP as a virtual forex, and nurture partnerships with banks, Liquidity Providers, and other financial establishments.

Ripple become created in 2012 via Chris Larsen and Jed McCaleb, two famous marketers and pioneers in the cryptocurrency and blockchain enterprise. In 2013, OpenCoin rebranded Ripple Labs. Since that point, Ripple Labs has worked to improve the XRP Ledger, promote using XRP as a virtual forex, and nurture partnerships with banks, Liquidity Providers, and other financial establishments.

How Ripple Works

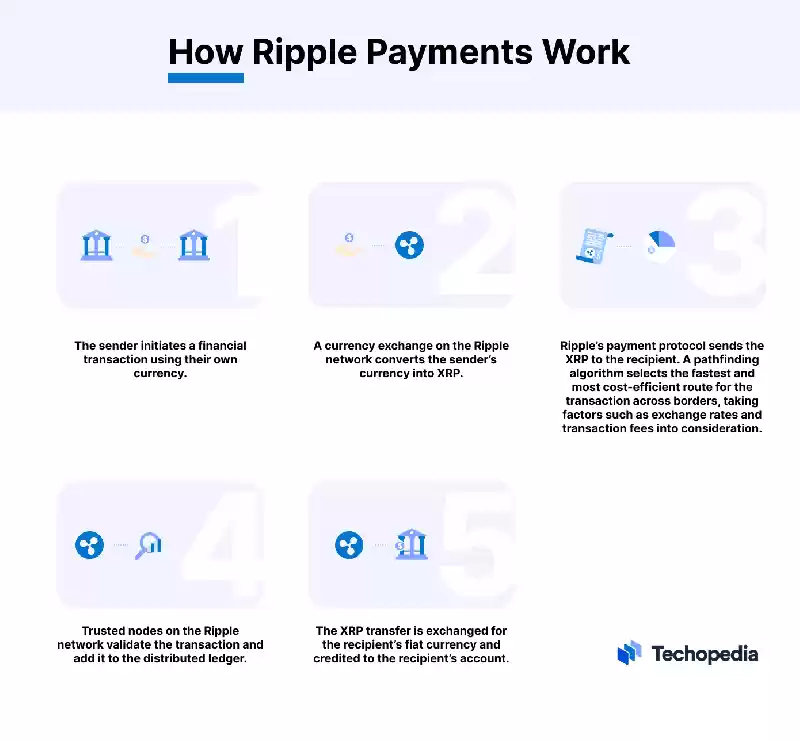

Here’s a excessive-stage review of ways Ripple works:

On the returned end, the Ripple platform consists of a currency trading, a actual-time gross settlement (RTGS) gadget, and a remittance network.

- A forex is a market that allows people and establishments to alternate, purchase, or sell special currencies.

- A Real-Time Gross Settlement (RTGS) Device is a monetary machine that enables the real-time Switch of price Range among two or extra banks or financial institutions.

- A remittance community is a platform that lets in individuals or agencies to ship and receive money across borders.

Uses Cases in Finance

The Ripple cross-border fee platform is designed to be used by individuals as well as corporations and monetary establishments together with banks and Charge vendors.

Today, some of the largest economic institutions in the international, which include Santander, Standard Chartered, and American Express, are the use of Ripple’s technology to eliminate a few of the inefficiencies and delays associated with sending money from one u . S . To any other. The platform is used to:

- Send and get hold of Direct Payments and cash transfers in one-of-a-kind currencies across borders quickly and securely.

- Settle pass-border economic transactions in real time instead of ready days or weeks for a transaction to clear.

- Reduce the fees related to move-border bills, which include charges charged by banks and other intermediaries.

- Reduce the capability for fraud or mistakes with the aid of permitting all events worried in a transaction to view and music the repute of a price in real time.

- Provide a remittance Carrier that permits individuals to ship cash to buddies and circle of relatives round the arena, with low transaction prices and real-time agreement.

- Allow crypto investors to shop for and sell XRP for profit. Currently, XRP is the arena’s sixth-biggest cryptocurrency by means of marketplace capitalization.

Ripple Labs additionally offers more than a few services and products beyond pass-border payments. They include:

On-Demand Liquidity: A service that leverages the virtual asset XRP to provide immediate liquidity for go-border transactions. Financial institutions can use Liquidity Hub to source liquidity on-demand, putting off the need for pre-funded nostro accounts and reducing the value and time related to go-border bills.

RippleNet Cloud: This is a cloud-based service that lets in financial establishments to without problems connect and combine with RippleNet, Ripple’s global charge network. RippleNet Cloud is understood for allowing faster Deployment, lower operational charges, and less complicated maintenance compared to traditional on-premises answers.

Line of Credit: Ripple Labs offers a line of credit carrier to eligible Clients, allowing them to get admission to finances for cross-border bills using XRP through ODL. This provider goals to help Businesses grow by means of imparting in advance capital for investments or enlargement.

University Blockchain Research Initiative (UBRI): Ripple Labs released UBRI to guide and boost up academic research, technical development, and innovation inside the blockchain, cryptocurrency, and digital payments sectors. The initiative partners with universities global.

Ripple Protocols

Ripple makes use of the Ripple Transaction Protocol, the Ripple Protocol Consensus Algorithm, and the Interledger Protocol to transfer digital and fiat foreign money throughout borders on the same community.

Each protocol plays a particular position in facilitating speedy and fee-powerful pass-border payments. RTXP (Ripple Transaction Protocol) outlines the overall structure and components required for transactions. RPCA (Ripple Protocol Consensus Algorithm) ensures the Integrity and protection of the Ripple ledger, and ILP (Interledger Protocol) allows move-ledger transactions between exclusive blockchain networks and traditional banking structures.

RTXP RTXP is an open-source protocol that makes use of a distributed ledger technology that’s similar to blockchain to facilitate go-border payments. The protocol is understood for its unique consensus mechanism, pathfinding algorithm, Gateways, and IOUs. Gateways are trusted currency exchange entities that act as Access and exit points for transactions within the Ripple community. Transactions are facilitated through IOUs, which constitute debt obligations among users and gateways.

RPCA RPCA is a consensus technique primarily based on the Practical Byzantine Fault Tolerance (PBFT) set of rules. The nodes at the Ripple network that take part within the consensus Procedure are referred to as validators. Validators are required to maintain a minimal quantity of XRP as a safety deposit to make certain they have got a stake within the network’s operation. Here is how the protocol works:

- When a transaction is initiated on the Ripple community, the sender’s Personal node validates the transaction and symptoms it with a personal key.

- The transaction is broadCast to a set of trusted nodes on the community.

- The nodes Upload the new transaction to a listing of other transactions that are waiting to be processed. This listing is referred to as the transaction pool.

- Each node reviews the brand new transaction within the transaction pool and creates a listing of transactions to encompass inside the subsequent ledger. This listing is called a candidate set of transactions.

- Each node stocks its candidate set with the opposite trusted nodes and opinions the candidate sets submitted by means of the alternative nodes.

- Each node makes a decision whether to preserve its candidate listing of transactions as is or optimize it the usage of element (or all) of any other node’s candidate list.

- This sySTEM of sharing, reviewing, and iteratively enhancing candidate units is repeated till a supermajority of nodes consents on a hard and fast of candidate transactions to include inside the subsequent ledger.

- Once a supermajority of validators agree on a hard and fast of candidate transactions, they invent a new ledger that includes those transactions and Publicizes it to the network. The ledger is then introduced to the blockchain, that's a tamper-obvious File of all transactions on the network.

ILP ILP is a decentralized, open-supply protocol that enables transactions across Exceptional charge networks and ledgers. ILP is based on connectors, a Routing Protocol, conditional bills, and a cryptographic unlocking mechanism to make sure stable, green, and interoperable transactions between numerous charge systems. Here is how the protocol works:

- The sender and Receiver set up or log into accounts with one or Greater connectors. Connectors function intermediaries among distinct charge networks or ledgers.

- The sender offers info of their transaction, together with the currency, the fee amount, and the destination.

- The sender and connectors alternate Routing statistics to determine the superior course among the sender and the receiver, which might also contain more than one hops thru one of a kind connectors.

- Once the course is decided, the sender requests a quote from the primary connector within the path. This quote includes Records about the exchange price, expenses, and other situations for the transaction.

- Upon receiving and accepting the quote, the sender initiates a conditional charge to the primary connector with a hashlock. This approach the charge is locked and may handiest be unlocked when the receiver offers a pReimage (a mystery value) that hashes to the price designated in the hashlock.

- The first connector Forwards the conditional price to the following connector within the path, and this technique maintains till the charge reaches the receiver’s connector. Each connector locks the charge the use of the equal hashlock situation.

- When the receiver’s connector receives the conditional fee, the receiver stocks the preimage with their connector to release the price range. The connector then forwards the preimage to the preceding connector in the route, and the system maintains in reverse until the sender’s connector gets the preimage.

- Once the sender’s connector receives the preimage, the price is taken into consideration fulfilled, and the receiver can get admission to the price range.

Regulatory Challenges

Ripple continues to be a topic of dialogue as concerns about centralization and the way Ripple Labs bought XRP raised questions about how the bridge foreign money must be treated under Modern-day legal guidelines and policies.

In 2020, the United States Securities and Exchange Commission (SEC) filed a lawsuit in opposition to Ripple Labs, its CEO, Brad Garlinghouse, and its co-founder, Chris Larsen, alleging that despite the fact that Ripple Labs and its executives had been conscious that XRP can be considered a security below federal securities laws, they endured to promote XRP as an unregistered security to fund their operations.

The outcome of this lawsuit is anticipated to have extensive implications for the cryptocurrency enterprise due to the fact it may set a precedent for how current U.S. Laws and rules might be used to supervise the crypto enterprise. If the SEC prevails within the case, and XRP is deemed a safety, it’s viable that other digital property might face similar regulatory scrutiny and be required to comply with U.S. Securities legal guidelines.

Impact of the SEC Lawsuit

Following the lawsuit, several Cryptocurrency Exchanges suspended or delisted XRP trading because of the bad sentiment surrounding Ripple Labs. The lawsuit also inspired media coverage that Highlighted the regulatory risks associated with making an investment in cryptocurrencies, especially people with uncertain legal repute. This, in flip, multiplied the volatility of XRP tokens in addition to Ripple liquidity

Some buyers, however, considered the lawsuit as an possibility. The terrible sentiment and uncertainty surrounding the lawsuit to start with brought about a drop in XRP’s charge, which supplied traders who believed inside the lengthy-time period capability of the task with an appealing entry factor.

How To Buy and Store XRP

In spite of the talk, XRP continues to be one of the pinnacle cryptocurrencies by market capitalization and has a high trading Volume due to the fact it's miles regularly used as a base currency for buying and selling pairs on cryptocurrency exchanges.

Here are the stairs required to purchase and keep XRP as an investment:

- First, pick out a reputable cryptocurrency exchange that helps XRP buying and selling. The Availability of XRP on exchanges may range relying at the investor’s location and neighborhood guidelines. Popular exchanges that list XRP include Binance, Bitstamp, Kraken, and Coinbase.

- Next, sign on for an account on the selected change and whole the required identification verification Method. Typically, this calls for the dealer to provide personal facts and upload identification files because most exchanges observe Know Your Customer (KYC) and Anti-Money Laundering (AML) rules.

- Once the account has been verified, it’s time to deposit price range into the change account using a favored price method.

- Next, navigate to the XRP buying and selling pair at the change and both region a purchase order at the contemporary marketplace fee or set a limit order at a particular fee.

Once the order is completed, the XRP might be credited to the exchange account. Although XRP may be saved at the trade, it’s taken into consideration a best exercise to switch it to a virtual pockets for better manipulate. There are unique kinds of XRP wallets to be had, which includes Software Program wallets (Computing device or Cellular), Hardware Wallets, and paper wallets.

-

- Software wallets: These are Packages that may be mounted on a Computer or mobile tool. Popular XRP-well matched software wallets encompass Trust Wallet.

- Hardware wallets: These are devoted bodily gadgets designed to securely store cryptocurrencies Offline. Ledger and Trezor are examples of hardware wallets that aid XRP.

- Paper wallets: A paper wallet includes printing XRP public and personal keys on paper and preserving the paper safe.

- To switch XRP from an change to a wallet, locate the “withdraw” or “send” choice on the alternate, enter the wallet’s XRP deal with, and specify the amount to switch. Always double-test the vacation spot deal with earlier than confirming the transaction.

What does XRP stand for?

When we refer to XRP as an acronym of Ripple (XRP), we mean that XRP is formed by taking the initial letters of each significant word in Ripple (XRP). This process condenses the original phrase into a shorter, more manageable form while retaining its essential meaning. According to this definition, XRP stands for Ripple (XRP).

Let's improve Ripple (XRP) term definition knowledge

If you have a better way to define the term "Ripple (XRP)" or any additional information that could enhance this page, please share your thoughts with us.

We're always looking to improve and update our content. Your insights could help us provide a more accurate and comprehensive understanding of Ripple (XRP).

Whether it's definition, Functional context or any other relevant details, your contribution would be greatly appreciated.

Thank you for helping us make this page better!

Frequently asked questions:

- What is the abbreviation of Ripple (XRP)?

- Abbreviation of the term Ripple (XRP) is XRP

- What does XRP stand for?

- XRP stands for Ripple (XRP)

Your Score to Ripple (XRP) definition

Score: 5 out of 5 (1 voters)

Be the first to comment on the Ripple (XRP) definition article