Total Value Locked (TVL)

What is Total Value Locked (TVL)?

Definition and meaning of Total Value Locked (TVL)

Total Value Locked (TVL) is a Metric used to measure the entire price of virtual belongings which can be locked or staked in a particular Decentralized Finance (DeFi) Platform or Decentralized Application (dApp).

The higher the TVL, the more truthful the platForm or dApp is gave the Impression to be.

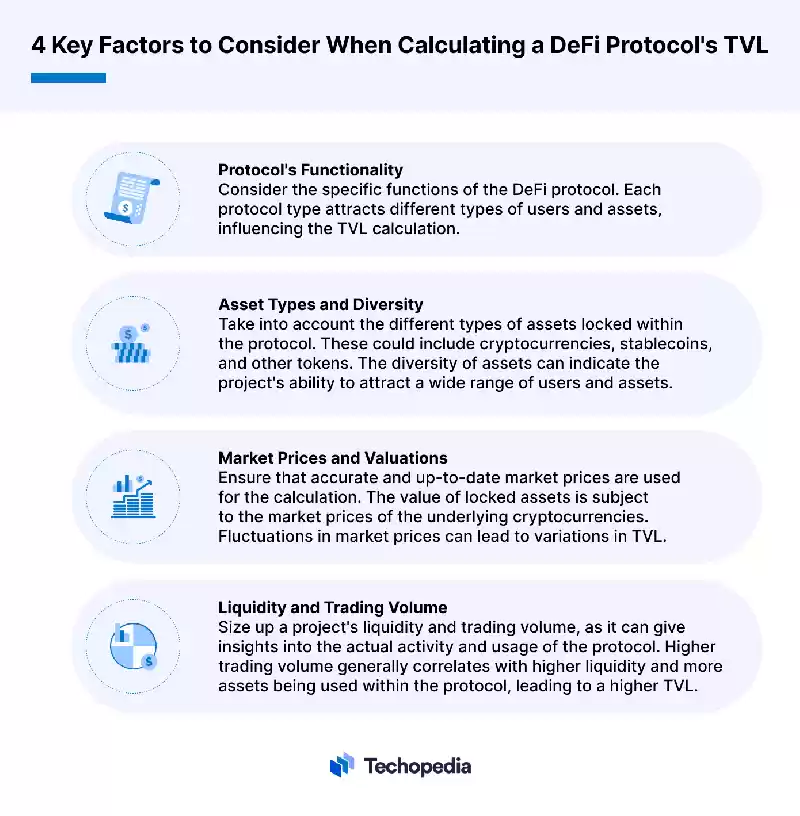

How Is TVL Calculated?

The Procedure usually includes including up the Digital Assets Currently locked in a specific DeFi Protocol or smart agreement. These assets may want to consist of cryptocurrencies, Stablecoins, or different Tokens which can be being used as collateral for loans or provide the platform with Liquidity.

For example, if a DeFi platform is calculating its very own general price locked and has $10 million really worth of ETH, $five million really worth of USDT, and $2 million really worth of different ERC-20 tokens locked in its clever agreement, then its TVL would be $17 million.

Usually, however, investors depend upon TVLs which have been calculated by using third-celebration DeFi Analytics sySTEMs. These structures use Application Programming Interfaces (APIs) and a process referred to as Web Scraping to acquire the statistics they want for the calculation.

Here are a few examples of TVLs published with the aid of the analyst platform DefiLlama on 28 August 2023.

- Lido: $13.9bn

- MakerDAO: $5.13bn

- Aave: $4.53bn

- JustLend: $3.36bn

- Uniswap: $three.33bn

The values are in all likelihood to be specific on some other day because crypto property in the DeFi atmosphere may be particularly risky.

Importance of TVL

TVL is an crucial metric because it presents customers with Records they are able to use to assess the risks and capability benefits of making an investment in a selected DeFi environment.

The hassle is that there isn’t a preferred for quantifying TVL, and one-of-a-kind analytics systems use different strategies to calculate the metric. This makes it hard for users to evaLuate TVL values across distinct systems.

Here are 3 examples of the way distinct analyst structures calculate overall value locked:

- DeFi Pulse: TVL is the total fee of all belongings deposited in a DeFi protocol which can be producing monetary activity.

- DeFiLlama: Total fee locked represents the wide Variety of assets which are being staked in a specific protocol in the interim.

- CoinGecko: TVL represents the total aMount of underlying quantity of funds that a DeFi protocol has secured or the quantity of assets which might be currently staked in a protocol.

Limitations of the Metric

Total price locked can be a beneficial metric for assessing the recogNition and utilization of a specific DeFi platform or project, however it’s essential for traders to understand its boundaries, together with the subsequent:

- TVL only measures the total fee of property which might be locked or staked in a platform, however it doesn’t don't forget things just like the real activity levels of users. If a platform has a excessive TVL but low tiers of user interest, this need to be a red Flag for investors.

- A platform with a high TVL might not always be a top notch or secure platform. It’s essential for customers to assess a platform’s reputation and protection regulations before making an investment.

- Fluctuations in TVL won't accurately mirror the fitness or lengthy-term capability of a particular task. TVLs can be easily stimulated with the aid of external elements consisting of market conditions, cHanges in Media insurance, Modifications in investor sentiment or the creation of recent protocols or DApps.

- When the use of a 3rd-birthday party Analytics Platform to research TVLs, the investor need to studies how often the platform UPDATEs its TVL facts to make sure the metric is Constantly up to date.

- In some Instances, the overall fee locked can be artificially inflated by way of malicious actors who need to draw more interest to a particular platform or mission. This could make it difficult for traders to accurately check the genuine reputation and utilization of a platform based on TVL on my own.

TVL ought to not be the only metric used to make an investment choice.

Due diligence have to additionally consist of studies into the platform’s governance version, its token economics, the power and Engagement of the platform’s Network, the depth of the platform’s liquidity pool, its guidelines concerning yield Farming, and its protection protocols and Methods.

What does TVL stand for?

When we refer to TVL as an acronym of Total Value Locked (TVL), we mean that TVL is formed by taking the initial letters of each significant word in Total Value Locked (TVL). This process condenses the original phrase into a shorter, more manageable form while retaining its essential meaning. According to this definition, TVL stands for Total Value Locked (TVL).

Let's improve Total Value Locked (TVL) term definition knowledge

If you have a better way to define the term "Total Value Locked (TVL)" or any additional information that could enhance this page, please share your thoughts with us.

We're always looking to improve and update our content. Your insights could help us provide a more accurate and comprehensive understanding of Total Value Locked (TVL).

Whether it's definition, Functional context or any other relevant details, your contribution would be greatly appreciated.

Thank you for helping us make this page better!

Frequently asked questions:

- What is the abbreviation of Total Value Locked (TVL)?

- Abbreviation of the term Total Value Locked (TVL) is TVL

- What does TVL stand for?

- TVL stands for Total Value Locked (TVL)

Your Score to Total Value Locked (TVL) definition

Score: 5 out of 5 (1 voters)

Be the first to comment on the Total Value Locked (TVL) definition article