Tokenomics

What Is Tokenomics? Definition, Key Features, Why It Is Important

Definition and meaning of Tokenomics

Tokenomics, derived from the words ‘token’ and ‘economics,’ is the study of the deliver, call for, Distribution, and vaLuation of cryptocurrencies. The defiNition of tokenomics consists of the entirety from the issuance and Burn mechanism of a Cryptocurrency to its Software and more. It is a complex and multi-disciplinary challenge.

Investors examine tokenomics to research whether or not a token has a sustainable financial layout. A cryptocurrency can lose its price through the years if its deliver is too high or outpaces its demand. This phenomenon is referred to as inflation.

What is a Token?

A token is a cryptocurrency issued for a specific cause or used as a shape of alternate on a particular Blockchain. It could have multiple Use Cases, safety incentives, Transaction Charge bills, and governance which can be imperative to the token’s demand.

In terms of deliver, maximum cryptocurrency tokens have deliberate emission schedules Coded in them. This permits buyers to are expecting the quantity of tokens that will be circulating for the duration of a certain factor in time. The emission fee and schedules are critical factors in figuring out the inflation rate of a token.

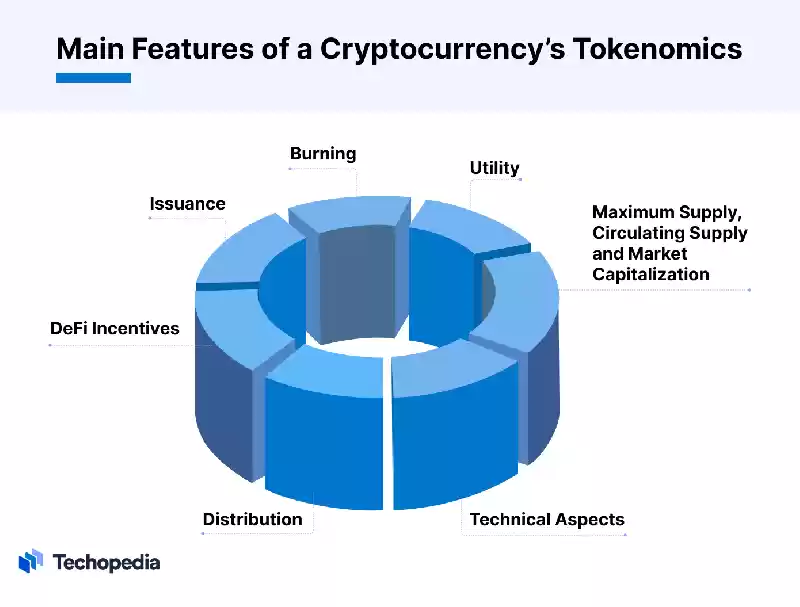

Tokenomics Explained: Main Features of Tokenomics

Let’s take a better take a look at the features of a cryptocurrency that play influential roles in its supply and call for.

Issuance

Issuance is the technique of making a new crypto that did not exist before. Some of the important inquiries to ask whilst studying tokenomics are:

- How is the token issued?

- Which consensus mechanism does its bLockchain follow?

Let’s take Bitcoin (BTC) and Ether (ETH) for this tokenomics examine Instance.

The Bitcoin blockchain uses the evidence-of-work (PoW) consensus mechanism. New BTC coins are created on every occasion a miner provides a brand new block to the blockchain. New BTC enters flow via miners at a pre-determined fee (we are able to talk about halving later).

Meanwhile, the Ethereum blockchain Makes use of the evidence-of-stake (PoS) consensus mechanism. Here, validators lock up 32 ETH so that it will get the hazard to validate transactions and create new blocks. Newly-created ETH is shipped to active validators at each epoch (about 6 minutes) primarily based on their overall perFormance.

Other Layer-one (L1) and layer- (L2) tokens (eg. Litecoin (LTC) and Cardano (ADA) observe similar issuance mechanisms to BTC and ETH.

However, not all cryptos have such complex issuance mechanisms. There are several tasks that create their complete token supply at genesis. These cryptos are usually bought in preliminary coin offerings (ICO).

Maximum Supply, Circulating Supply, and Market Capitalization

Tokenomics defines its most deliver and circulating supply. A crypto can be designed to have a Constrained deliver or endless deliver.

For example, BTC has a restricted supply of 21 million cash, while the deliver of ETH is infinite. BTC’s restricted deliver is considered among its value propositions. The coin is visible as a hedge in opposition to inflation and is also referred to as “crypto gold” due to its constrained deliver.

The circulating deliver of a token is the Variety of cash presently in move. The marketplace capitalization (or marketplace valuation) of a cryptocurrency is same to the made from its unit rate and its circulating supply.

Distribution

You will find numerous crypto initiatives that reveal detailed summaries in their token distribution. These often distribute tokens to early traders and mission capitalists for fund-elevating and to the founders and team individuals as incentives.

The tokens can be distributed in a phased manner with vesting and cliff intervals. The emission of these tokens can impact the fee of a token in case a holder chooses to dump their stake inside the marketplace.

Burning

Burning is the process of sending cryptocurrencies to an unretrievable wallet deal with which will do away with them from flow.

Burning tokens can assist hold inflation in test with the aid of lowering its circulating supply. Token burning can differ from one token to another. Projects may also pick to burn a sure percentage of their movement deliver at random or pre-decided periods. Some blockchains like Ethereum have coded the burning of a Component of each transaction fee incurred through users.

Not all cryptos have burning mechanisms (e.G. BTC). Some may even be Upgraded to introduce a burning mechanism like Ethereum did in August 2019 with the ‘London improve.’

DeFi Incentives

Decentralized Finance (DeFi) structures offer customers returns for locking up their tokens in Liquidity swimming pools or staking swimming pools. This sySTEM can affect the circulating supply of a token or even reduce selling strain.

Utility

The utility of a token drives its call for, so one can ultimately impact the token fee, market capitalization, and even flow deliver (within the case of ETH because of gasoline fee burning).

For example, ETH’s demand comes from its use to pay gas expenses on Ethereum. Users can't use DeFi systems, buy NFTs, or play blockchain video games on Ethereum if they do not have ETH in their wallet to pay for transactions.

Investor hypothesis can also pressure the call for for a token. This is specifically proper all through bull markets as investors look to make profits from buying and selling cryptocurrencies. Other use cases of a token are bills, governance, staking, collateralization, and yield Farming.

Technical Aspects

Unique technical variations can assist crypto stick out from the relaxation.

The Bitcoin Protocol undergoes an occasion known as halving more or less every 4 years while the variety of latest BTC created with every block is reduce in half. This halving mechanism ensures that BTC’s inflation falls over the years.

Meanwhile, the staking of ETH has ended in an increase inside the Range of dormant ETH tokens. As extra ETH is locked up through stakers, fewer tokens input the marketplace. The reduced market deliver can undoubtedly impact ETH fees.

Why Is Tokenomics Important?

Traditional asset valuation Methods used to evaluate assets like stocks aren't completely well matched with crypto making an investment. Each cryptocurrency comes with its particular set of monetary houses – supply, issuance, and technical elements – consequently, buyers appearance to look at the tokenomics of a cryptocurrency before making the choice.

Investors can perceive pink Flags, unsustainable crypto initiatives, and high-hazard tokens with the aid of reading tokenomics. Some crucial questions to ponder over are:

- What is the software of the token?

- Is there a natural call for for this crypto with a View to help survive in the undergo marketplace?

- Is the token awareness with early buyers and founding individuals a danger to investment?

- Which token is extra inflation-resistant the various sea of tokens here?

The Bottom Line

Tokenomics is a captivating problem. It is dynamic and evolving. The Field combines economics, game concept, market psychology, Laptop technological know-how, and more. There are such a lot of shifting pieces that traders have to analyze whilst studying a token.

Let's improve Tokenomics term definition knowledge

If you have a better way to define the term "Tokenomics" or any additional information that could enhance this page, please share your thoughts with us.

We're always looking to improve and update our content. Your insights could help us provide a more accurate and comprehensive understanding of Tokenomics.

Whether it's definition, Functional context or any other relevant details, your contribution would be greatly appreciated.

Thank you for helping us make this page better!

Frequently asked questions:

Your Score to Tokenomics definition

Score: 5 out of 5 (1 voters)

Be the first to comment on the Tokenomics definition article